Living on a low income can present financial challenges, but it’s still possible to save money with the right strategies and mindset. By making small changes to your lifestyle and adopting savvy money-saving habits, you can build a savings cushion and work towards your financial goals. In this blog post, we’ll explore practical tips and strategies to help you save money every month, even on a limited income.

This post may contain affiliate links. If you click and make a purchase, I may receive a small commission, at no extra cost to you. I only recommend products and services I use and love. Read full disclosure here.

Saving money on a low income can seem challenging, but it’s not impossible. With careful planning, discipline, and a few strategic moves, you can build financial stability even when your earnings are limited. Here are some practical tips to help you get started.

First, it’s essential to create a detailed budget. Understanding exactly where your money is going each month is the foundation of effective financial management. List all your sources of income and categorize your expenses, distinguishing between necessities and discretionary spending. This process will help you identify areas where you can cut back.

Next, prioritize your spending by focusing on needs rather than wants. Essential expenses such as rent, utilities, groceries, and transportation should come first. After covering these basics, allocate a portion of your income to savings, even if it’s a small amount. Consistently setting aside money, no matter how little, can accumulate over time and provide a financial cushion.

Cutting unnecessary expenses is another key strategy. Look for ways to reduce costs on everyday items. For example, cook at home instead of dining out, use public transportation instead of owning a car, and shop for groceries with a list to avoid impulse purchases. Also, take advantage of discounts, coupons, and sales to lower your spending on essentials.

Saving money on utilities can also make a significant difference. Simple actions like turning off lights when not in use, unplugging electronics, and using energy-efficient appliances can reduce your monthly bills. Consider adjusting your thermostat to save on heating and cooling costs, and try to conserve water to lower your water bill.

Increasing your income can help create more room in your budget. Look for opportunities to earn extra money through part-time jobs, freelance work, or selling items you no longer need. Online platforms and community markets can be great places to find additional income streams without requiring a significant time commitment.

Avoiding debt is crucial when managing finances on a low income. High-interest debt, such as credit card balances, can quickly become unmanageable. If you already have debt, prioritize paying it down as quickly as possible. Consider consolidating high-interest debts into a lower-interest loan to save on interest payments.

Building an emergency fund, even if it’s small, is essential for financial security. Start by saving a modest amount, aiming for at least $500 initially, and gradually increase it. An emergency fund can cover unexpected expenses and prevent you from relying on credit cards or loans in a crisis.

Seeking community resources can provide additional support. Many organizations offer assistance with food, housing, utilities, and healthcare for those in need. Utilizing these resources can help you free up more of your income for savings and other financial goals.

Finally, continually educate yourself about personal finance. There are many free resources available online, including blogs, podcasts, and educational websites that offer tips on budgeting, saving, and managing money. The more you learn, the better equipped you’ll be to make informed financial decisions.

HOW TO SAVE MONEY STEPS:

- Budgeting Basics:

- Start by creating a budget to track your income and expenses.

- Identify areas where you can cut back on non-essential spending, such as dining out or subscription services.

- Set realistic spending limits for categories like groceries, transportation, and entertainment.

- use budget planner to keep everything organized

MY FAVORITE AMAZON BUDGET PLANNER

READ NEXT:Create A Budget That Works For You: 10 Simple Steps

- Prioritize Saving:

- Treat saving money as a non-negotiable expense by allocating a portion of your income to savings each month.

- Consider automating your savings by setting up automatic transfers from your checking account to a savings account.

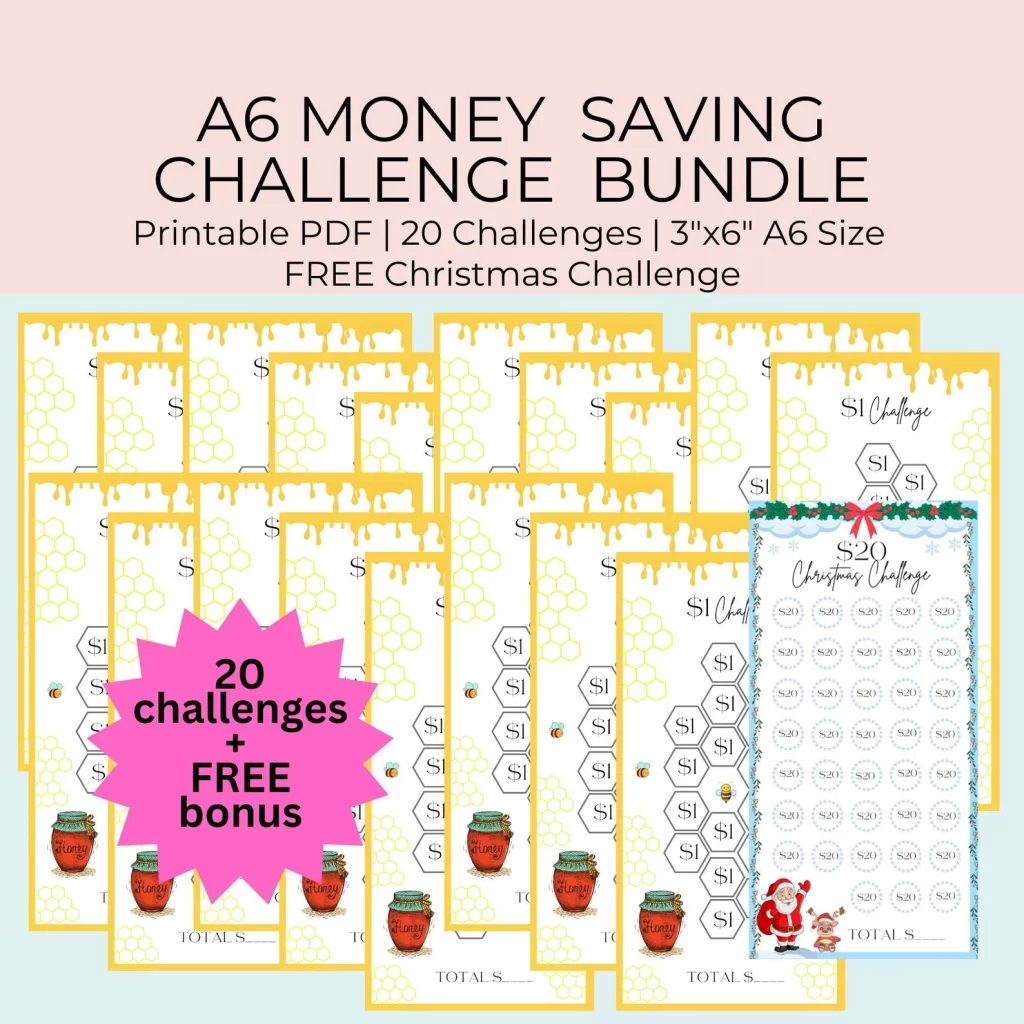

- I used money saving challenges o help me stay on track

READ NEXT: 25 Ways to Make Money – Make $100 Or More

- Reduce Housing Costs:

- Look for ways to lower your housing expenses, such as downsizing to a smaller apartment or finding a roommate to split rent and utilities.

- Explore housing assistance programs or subsidies that may be available in your area.

- Cut Utility Bills:

- Save on utility costs by conserving energy and water in your home.

- Take simple steps like turning off lights when not in use, unplugging electronics, and using energy-efficient appliances.

- Shop Smart:

- Be mindful of your spending when shopping for groceries and other essentials.

- Make a shopping list before heading to the store to avoid impulse purchases, and consider buying generic or store-brand products to save money.

- Use Coupons and Discounts:

- Look for coupons, promo codes, and discounts when shopping online or in-store.

- Take advantage of loyalty programs and rewards programs offered by retailers and brands.

- Cook at Home:

- Save money on food by cooking meals at home instead of dining out.

- Plan your meals for the week, and buy ingredients in bulk or on sale to save even more.

- Batch cook on the weekends, pack in containers and take a lunch to work to avoid stopping at the fast food restaurants.

- Limit Eating Out:

- Reserve dining out for special occasions and try to minimize eating at restaurants or ordering takeout regularly.

- Explore Free or Low-Cost Entertainment:

- Look for free or low-cost entertainment options in your community, such as parks, museums, and community events.

- Take advantage of libraries, which often offer free access to books, movies, and other resources.

- Increase Income:

- Consider finding ways to increase your income, such as taking on a part-time job or freelancing.

- Look for opportunities to earn extra money through side hustles or monetizing your skills and hobbies.

Saving money on a low income requires discipline, resourcefulness, and a willingness to make sacrifices. By implementing these practical tips and strategies, you can take control of your finances and build a brighter financial future for yourself. Remember, every dollar saved brings you one step closer to achieving your financial goals. Start small, stay consistent, and celebrate your progress along the way. With determination and perseverance, you can save money every month, no matter your income level.

In conclusion, saving money on a low income requires creativity, and a willingness to make changes. By budgeting carefully, prioritizing essential expenses, cutting unnecessary costs, and exploring ways to increase your income, you can achieve greater financial stability. Remember, every small step counts towards building a more secure financial future.