Budget planning and creating a budget planner is one of the most effective ways to take control of your finances. Whether you’re looking to save for a big purchase, pay off debt, or simply ensure you’re living within your means, a well-structured budget can be your best tool. In this blog post, we’ll explore how to create a detailed budget planner, complete with practical examples and actionable ideas to help you stay on track.

This post may contain affiliate links. If you click and make a purchase, I may receive a small commission, at no extra cost to you. I only recommend products and services I use and love. Read full disclosure here.

Budget Planning And Why You Need a Budget Planner

A budget planner helps you:

- Track Income and Expenses: Know exactly where your money comes from and where it goes.

- Set Financial Goals: Whether it’s saving for a vacation, a new car, or retirement, a budget helps you allocate funds towards your goals.

- Avoid Debt: Prevent overspending by understanding your financial limits.

- Achieve Peace of Mind: Reduce financial stress by having a clear plan.

Steps to Create a Budget Planner

1. Assess Your Income

Start by calculating your total monthly income. This includes:

- Salary after taxes

- Freelance earnings

- Rental income

- Any other sources of regular income

Example:

- Salary: $3,000

- Freelance: $500

- Rental Income: $700

- Total Monthly Income: $4,200

2. List Your Expenses

Categorize your expenses into fixed and variable costs.

Fixed Expenses:

- Rent/Mortgage: $1,200

- Car Payment: $300

- Insurance (Health, Car, Home): $200

- Subscriptions (Netflix, Gym, etc.): $50

Variable Expenses:

- Groceries: $400

- Utilities (Electricity, Water, Gas): $150

- Transportation (Gas, Public Transit): $100

- Entertainment (Eating Out, Movies): $200

- Miscellaneous: $150

Total Fixed Expenses: $1,750 Total Variable Expenses: $1,000 Total Expenses: $2,750

READ NEXT: HOW TO SAVE MONEY EVERY MONTH ON A LOW INCOME FAST

3. Determine Your Savings Goals

Identify how much you want to save each month and what you’re saving for.

Example Savings Goals:

- Emergency Fund: $200/month

- Vacation Fund: $100/month

- Retirement Fund: $300/month

Total Savings: $600

4. Allocate Your Income

Subtract your total expenses and savings from your income to see how much discretionary income you have.

Calculation:

- Total Income: $4,200

- Total Expenses: $2,750

- Total Savings: $600

- Discretionary Income: $850

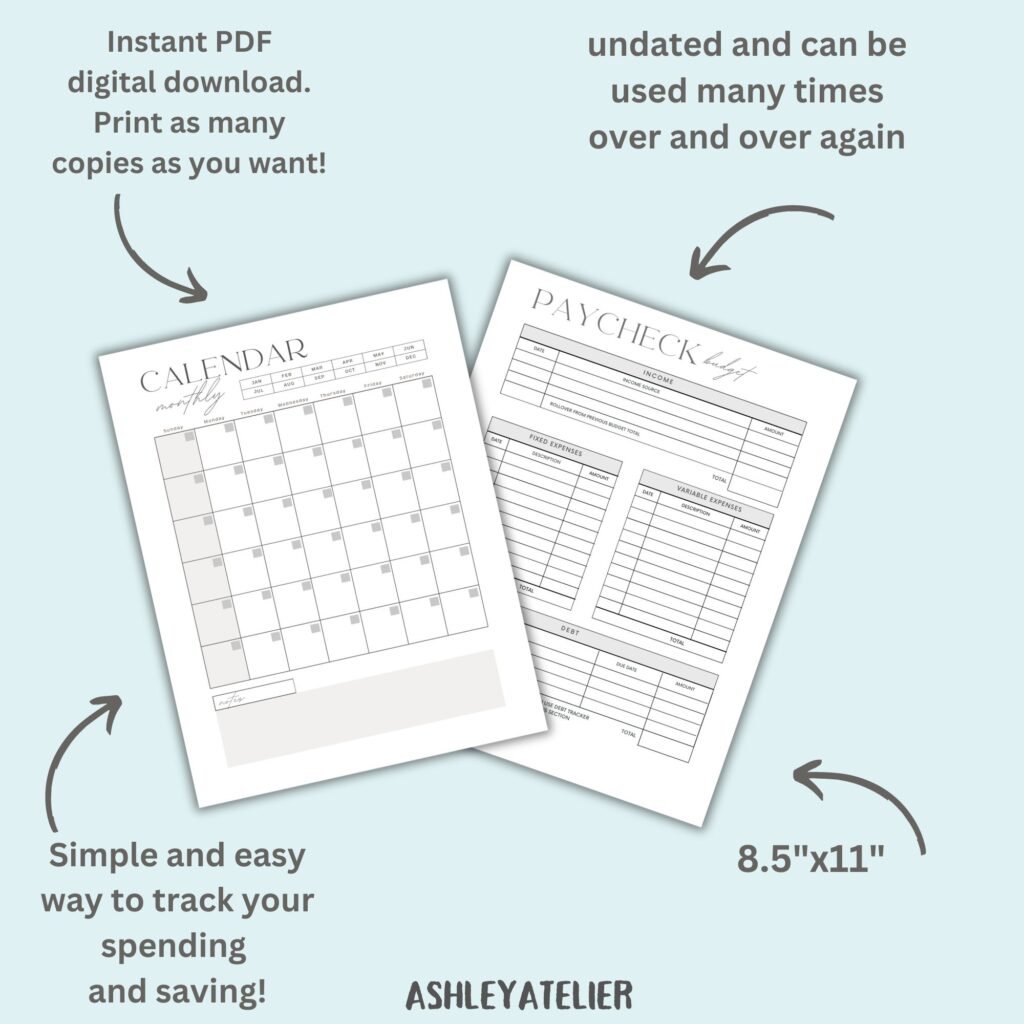

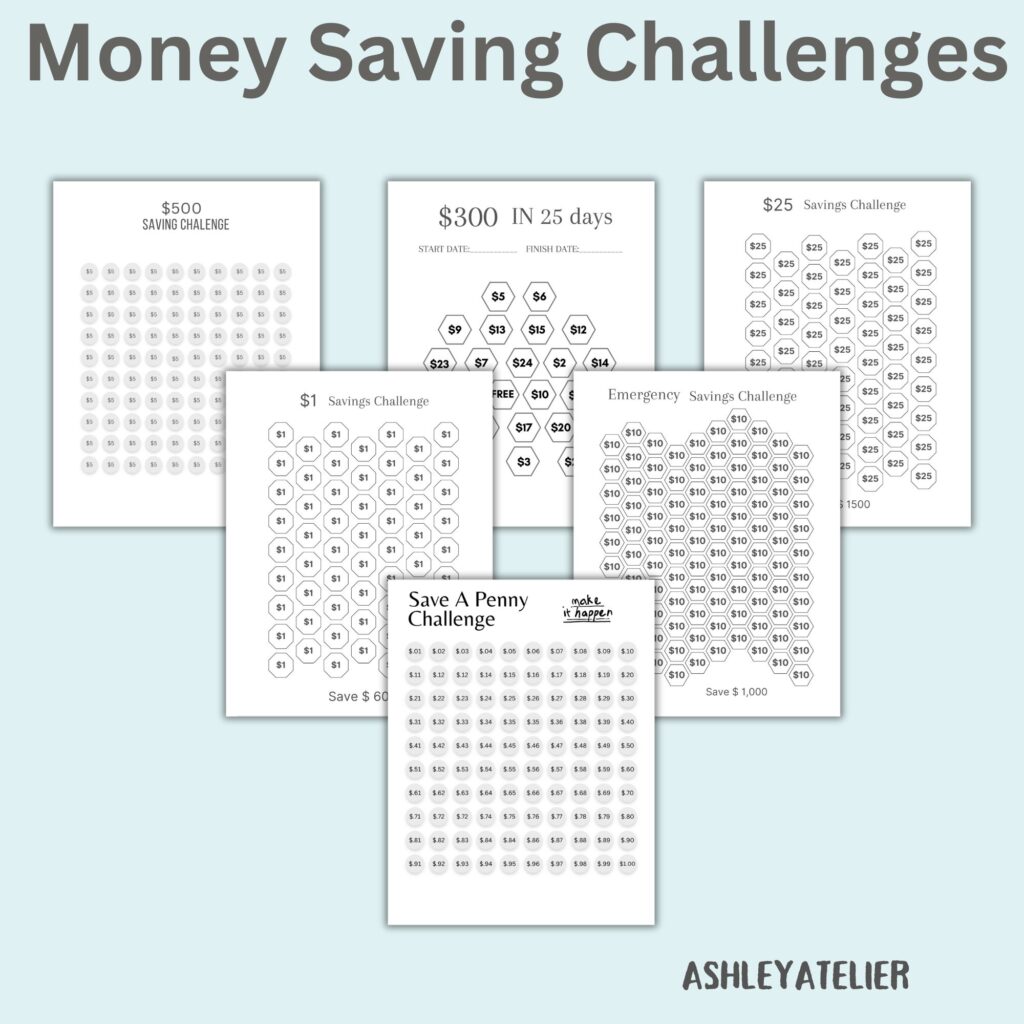

MONEY SAVING CHALLENGES INCLUDED IN THIS FREE BUDGET PLANNER

5. Adjust and Monitor

If your expenses exceed your income, you’ll need to adjust either your spending or your savings goals. Track your spending throughout the month to ensure you’re staying within your budget.

Examples of Budget Planner Formats

Example 1: Simple Spreadsheet

Create a spreadsheet with columns for Income, Expenses, Savings, and Balance. Update it weekly to track your progress.

Income:

| Source | Amount |

|---|---|

| Salary | $3,000 |

| Freelance | $500 |

| Rental Income | $700 |

| Total | $4,200 |

Expenses:

| Category | Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Car Payment | $300 |

| Insurance | $200 |

| Groceries | $400 |

| Utilities | $150 |

| Transportation | $100 |

| Entertainment | $200 |

| Miscellaneous | $150 |

| Total | $2,700 |

Savings:

| Goal | Amount |

|---|---|

| Emergency Fund | $200 |

| Vacation Fund | $100 |

| Retirement Fund | $300 |

| Total | $600 |

Balance:

| Description | Amount |

|---|---|

| Income | $4,200 |

| Expenses | $2,750 |

| Savings | $600 |

| Discretionary | $850 |

Example 2: Envelope System

For those who prefer a cash-based approach, the envelope system can be very effective. Allocate cash into envelopes for each spending category (e.g., groceries, entertainment). Once an envelope is empty, you can’t spend any more in that category until the next month.

Tips for Sticking to Your Budget

- Automate Savings: Set up automatic transfers to your savings accounts.

- Use Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track your spending in real-time.

- Review Regularly: Assess your budget monthly and make adjustments as needed.

- Plan for Irregular Expenses: Set aside funds for irregular but inevitable expenses like car repairs or medical bills.

- Be Flexible: Life is unpredictable, so be prepared to adjust your budget as needed.

Advanced Budgeting Techniques

Once you’ve mastered the basics of budgeting, you can explore more advanced techniques to optimize your financial planning and achieve greater financial freedom.

1. Zero-Based Budgeting

Zero-based budgeting involves assigning every dollar of your income to a specific purpose, so your income minus expenses equals zero. This method ensures that no money is unaccounted for.

Example:

- Income: $4,200

- Expenses: $2,750

- Savings: $600

- Debt Repayment: $850

- Total: $4,200 – $2,750 – $600 – $850 = $0

2. 50/30/20 Rule

The 50/30/20 rule is a simplified approach to budgeting where:

- 50% of your income goes to needs (housing, utilities, groceries).

- 30% goes to wants (entertainment, dining out, hobbies).

- 20% goes to savings and debt repayment.

Example:

- Income: $4,200

- Needs (50%): $2,100

- Rent/Mortgage: $1,200

- Utilities: $150

- Groceries: $400

- Transportation: $100

- Insurance: $250

- Wants (30%): $1,260

- Entertainment: $200

- Dining Out: $150

- Subscriptions: $50

- Miscellaneous: $860

- Savings/Debt (20%): $840

- Savings: $600

- Debt Repayment: $240

3. Sinking Funds

Sinking funds are savings for specific future expenses. Instead of being caught off guard by irregular expenses, you regularly set aside small amounts to prepare for them.

Examples:

- Car Maintenance: $50/month

- Holiday Gifts: $25/month

- Annual Insurance Premium: $40/month

Leveraging Technology for Budgeting

Budgeting Apps

Utilize technology to streamline your budgeting process. Some popular apps include:

- Mint: Tracks all your accounts, categorizes transactions, and provides insights on spending habits.

- YNAB (You Need A Budget): Emphasizes proactive budgeting and helps you allocate funds to specific categories.

- PocketGuard: Shows how much you have available to spend after accounting for bills, goals, and necessities.

Spreadsheet Templates

If you prefer a more hands-on approach, use spreadsheet templates from platforms like Google Sheets or Excel. These templates often come with built-in formulas to help you track and analyze your spending.

Practical Tips for Reducing Expenses

- Cut Unnecessary Subscriptions: Review your subscriptions and cancel any you don’t use regularly.

- Cook at Home: Save money by cooking meals at home instead of dining out.

- Energy Efficiency: Reduce utility bills by using energy-efficient appliances and habits.

- Shop Smart: Use coupons, shop sales, and buy in bulk to save on groceries and household items.

- DIY Where Possible: Handle minor repairs and projects yourself instead of hiring professionals.

Building an Emergency Fund

An emergency fund is crucial for financial stability. Aim to save 3-6 months’ worth of living expenses to cover unexpected events like job loss, medical emergencies, or major repairs.

Steps to Build an Emergency Fund

- Set a Goal: Determine the amount you need based on your monthly expenses.

- Open a Separate Account: Keep your emergency fund in a separate, easily accessible savings account.

- Automate Savings: Set up automatic transfers to your emergency fund account each payday.

- Prioritize Consistency: Contribute regularly, even if it’s a small amount.

Debt Repayment Strategies

Reducing debt is essential for financial health. Here are two effective strategies:

1. Debt Snowball Method

- Focus on paying off the smallest debt first while making minimum payments on others.

- Once the smallest debt is paid, roll its payment into the next smallest debt.

- Continue this process until all debts are paid.

Example:

- Credit Card 1: $500 (Monthly Payment: $50)

- Credit Card 2: $1,000 (Monthly Payment: $100)

- Student Loan: $5,000 (Monthly Payment: $200)

Start with Credit Card 1. Once it’s paid off, add its $50 payment to the $100 payment for Credit Card 2, making it $150, and so on.

2. Debt Avalanche Method

- Focus on paying off the debt with the highest interest rate first while making minimum payments on others.

- Once the highest interest debt is paid, roll its payment into the next highest interest debt.

- Continue this process until all debts are paid.

Example:

- Credit Card 1: $500 at 18% APR

- Credit Card 2: $1,000 at 12% APR

- Student Loan: $5,000 at 6% APR

Start with Credit Card 1 due to its higher interest rate. Pay it off as quickly as possible, then move to Credit Card 2, and finally the Student Loan.

Investing for the Future

Investing is a crucial part of growing your wealth. Here are some steps to get started:

- Set Investment Goals: Define your financial goals, such as retirement, buying a home, or education expenses.

- Understand Risk Tolerance: Determine how much risk you’re comfortable taking based on your financial situation and goals.

- Diversify: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk.

- Educate Yourself: Learn about different investment options and strategies through books, online courses, and financial advisors.

- Start Early: The sooner you start investing, the more time your money has to grow through compound interest.

Budgeting is not just about restricting your spending; it’s about making your money work for you. By tracking your income, categorizing your expenses, setting realistic savings goals, and regularly reviewing your progress, you can take control of your financial future. Start today, and watch your financial health improve!

Remember, the key to successful budgeting is consistency and adaptability. Keep your goals in sight, and don’t be afraid to make adjustments along the way. Happy budgeting!