This post may contain affiliate links. If you click and make a purchase, I may receive a small commission, at no extra cost to you. I only recommend products and services I use and love. Read full disclosure here.

Budgeting is an essential part of managing your finances, and finding a method that works for you can make all the difference. One effective budgeting technique that many people find helpful is the Half Payment Method. This method simplifies budgeting by breaking down your monthly bills into two smaller payments, allowing you to manage your expenses more efficiently. If you’re looking for a practical way to keep your finances on track, the Half Payment Method might be perfect for you. In this guide, we’ll walk you through the steps to start using this budgeting technique and explain why it can be a game-changer for your financial health.

What is the Half Payment Method?

The Half Payment Method involves splitting your monthly bills into two equal parts and paying half of each bill with each paycheck. For example, if you receive your salary twice a month, you would allocate half of your monthly rent, utilities, and other recurring expenses from each paycheck. This way, by the time your bills are due, you already have the full amount set aside without feeling overwhelmed by a large, single payment.

Benefits of the Half Payment Method

- Improved Cash Flow Management: By dividing bills into smaller, more manageable payments, you avoid large cash outflows all at once, making it easier to manage cash flow.

- Reduced Financial Stress: Smaller payments are less daunting than one large payment, reducing the stress and anxiety that comes with budgeting.

- Avoid Late Fees and Overdrafts: With regular, smaller payments, you’re less likely to face late fees or overdraft charges because your bills are being paid on time and your bank balance remains steady.

- Easier Saving and Budgeting: Knowing exactly how much will be deducted each payday helps you plan better for savings and other financial goals.

How to Start Using the Half Payment Method

Starting with the Half Payment Method requires a bit of preparation, but once set up, it can be quite straightforward. Here’s a step-by-step guide to get you started:

1. Review Your Current Budget

Before implementing the Half Payment Method, you need to have a clear understanding of your current budget. List all of your monthly bills, such as rent, utilities, groceries, loan payments, and subscriptions. Note the due dates and amounts for each bill. Understanding your current financial obligations will help you know how much needs to be split across paychecks.

2. Identify Your Pay Schedule

Determine how often you receive your income. Most people get paid either bi-weekly or semi-monthly. If you receive a paycheck every two weeks, there will be two months each year when you receive three paychecks. This can be a great opportunity to boost your savings or pay down debt faster.

3. Divide Your Bills in Half

Once you know your monthly expenses and your pay schedule, divide each bill amount by two. For example, if your rent is $1,200 a month, set aside $600 from each paycheck. Do this for every bill that is a recurring monthly expense. The idea is to have half of each bill’s amount ready to go from each paycheck so that when the bill is due, you have the full amount available.

READ NEXT: HOW TO SAVE MONEY EVERY MONTH ON A LOW INCOME FAST

READ NEXT: 25 WAYS TO MAKE MONEY-MAKE $100 OR MORE

4. Adjust Your Automatic Payments

Next, adjust any automatic payments to align with your new budgeting method. Set your bill payments to go out after you’ve saved half of the required amount from each paycheck. This may involve changing due dates with service providers or banks to ensure everything aligns smoothly.

5. Open a Separate Savings Account for Bills

To keep things organized, consider opening a separate savings account dedicated solely to your bills. Each payday, transfer the half payment amounts for all your bills into this account. This strategy helps keep your spending money separate from the money allocated for bills, reducing the temptation to spend it on non-essential items.

6. Automate Your Transfers and Payments

Set up automatic transfers from your main account to your bill savings account for each payday. You can also automate bill payments from this account. Automation helps prevent missed payments and makes the Half Payment Method almost effortless once it’s set up.

7. Track Your Progress Regularly

Regularly review your budget to ensure the Half Payment Method is working as intended. Track your expenses, check that each payment has been covered, and adjust your budgeting as necessary. If you find you’re consistently short on cash, it may be time to reassess your expenses and find areas to cut back.

Tips for Successfully Using the Half Payment Method

- Start Small: If managing all bills with the Half Payment Method seems overwhelming, start by splitting just one or two major expenses, such as rent or a loan payment. Gradually add more bills as you get comfortable.

- Keep an Eye on Your Balance: Ensure your checking account always has enough funds to cover both your transfers and daily expenses. This prevents overdrafts and keeps your budget on track.

- Use a Budgeting App: There are many apps available that can help you manage your budget, automate transfers, and track your spending. These tools can be invaluable when adopting a new budgeting method.

- Stay Flexible: Life is unpredictable, and sometimes unexpected expenses will come up. Be prepared to adjust your budget as needed and always have a small emergency fund to cover surprises.

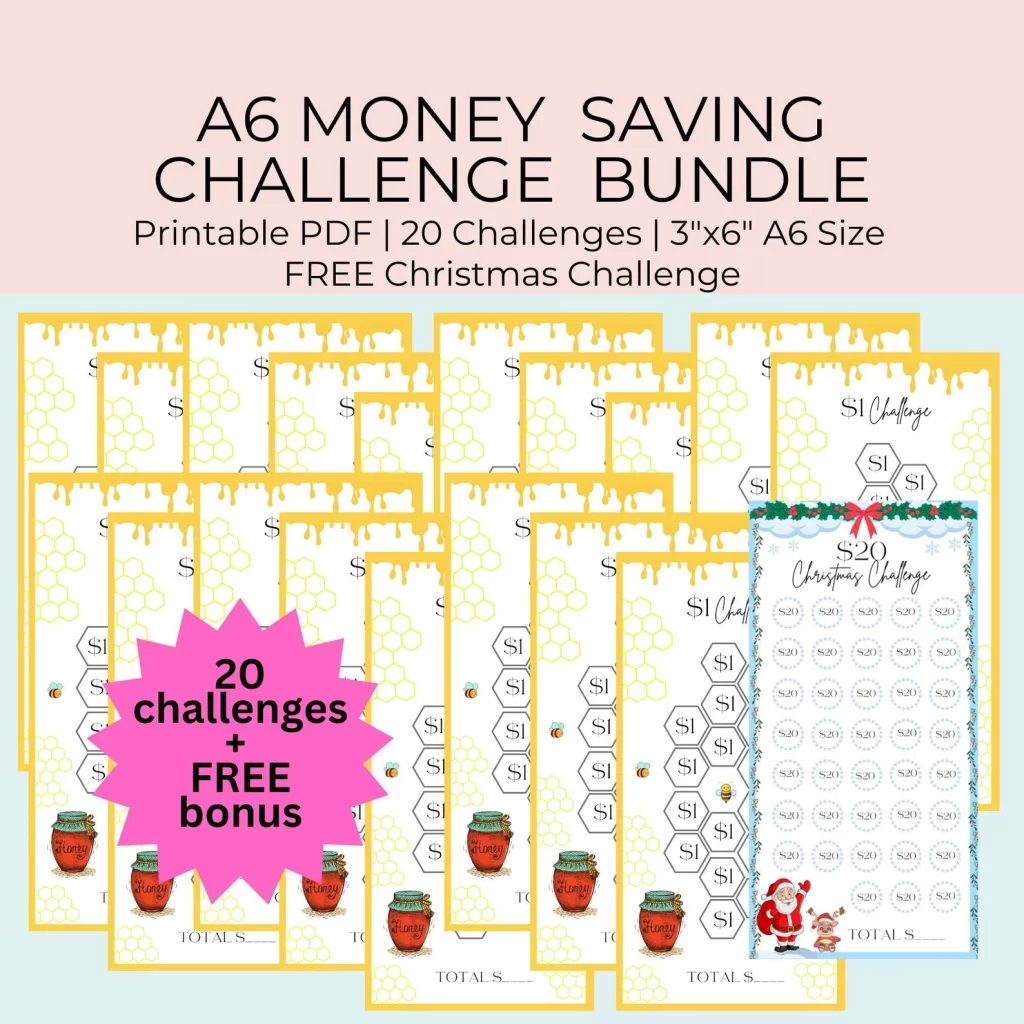

- Consider using Money Saving Challenges

Challenges You May Face and How to Overcome Them

- Initial Setup Effort: The first month or two might feel challenging as you adjust to splitting your payments and setting up your budget. To overcome this, start with just one or two bills to get a feel for the process before expanding.

- Misalignment with Payment Due Dates: Sometimes, it may be tricky to align your bill due dates perfectly with your pay schedule. Contact service providers to see if they can adjust your due dates. Many companies are flexible if you explain your budgeting strategy.

- Temptation to Use Set-Aside Funds: Keeping bill money separate in a dedicated account can help avoid the temptation to use it for other expenses. Think of this account as “untouchable” until bills are due.

Why the Half Payment Method Works

The Half Payment Method is a great approach for those who want to avoid the stress of large, single payments and who prefer a more steady and controlled cash flow. It teaches discipline by helping you allocate your funds more evenly and encourages saving by preventing large, end-of-the-month expenses from draining your account.

Conclusion

The Half Payment Method is a practical, easy-to-implement budgeting technique that can help you manage your finances more effectively. By breaking your bills into smaller, more manageable payments, you can reduce stress, avoid late fees, and achieve better control over your money. Start small, stay consistent, and watch how this method can transform your budgeting and bring more peace to your financial life. Give it a try and experience the difference it makes in your budgeting journey!